Son: Dad, may I speak with you?

Dad: Go ahead.

Son: Among all my classmates, I am the only one without a car. It is embarrassing.

Dad: What do you want me to do?

Son: I need a car. I don’t want to feel odd.

Dad: Do you have a particular car in mind?

Son: Yes dad (smiling)

Dad: How much?

Son: 200,000 pesos

Dad: I will give you the money on one condition.

Son: What is the condition?

Dad: You will not use the money to buy a car but invest it. If you make enough profit from the investment, you can go ahead and buy the car.

Son: Deal.

Then, the father gave him a cheque of 200,000 pesos. The son cashed the cheque and invested it in obedience to the verbal agreement that he had with his father.

Some months later, the father asked the son how he was faring. The son responded that his business was improving. The father left him.

After some months again, the father asked him about his business

again and the son told him that he is making a lot of profit from the business.

When it was exactly a year after he gave him the money, the father asked him to show him how far the business has gone. The son readily agreed and the following discussion took place:

Dad: From this I can see that you have made a lot of money.

Son: Yes dad.

Dad: Do you still remember our agreement?

Son: Yes

Dad: What is it?

Son: We agreed that I should invest the money and buy the car from the profit.

Dad: Why have you not bought the car?

Son: I don’t need the car again. I want to invest more.

Dad: Good. You have learnt the lessons that I wanted to teach you.

– You didn’t really need the car, you just wanted to feel among. That would have placed extra financial obligations on you. It wasn’t an asset then; but a liability.

– Two, it is very important for you to invest in your future before living like a king.

Son: Thanks dad.

Then the father gave him the keys of the latest model of that car.

MORALS:

1. Always invest first before you start living the way you want.

2. What you see as a need now may become a want if you can take a little time to get over your feelings.

3. Try to be able to distinguish between an asset and a liability so that what you see as an asset today will.

Very True. THanks for sharing.

This is very insightful on how to manage and make good use of resources when given the opportunity to handle it. Learning /obeying and heed to advice is important and can change the life of an individual or company forever

Very important dialogue, I appreciate you

Yes, this is one of the inspired exemplo in life, we need to give the priority in asset and not asset the liability

Lessons well learnt especially the distinction between and asset and liability has broadened my knowledge. We mingle with what we could invest and grow our businesses rather decide to buy something that we are liable to spend money on without any returns. Thank you.

It is interesting that , the father way of thought for his son is impressive. The way of agreement changed the son mind to think long-term success and more achievement than the current peer infulence interest on driving luxurious car. The son understood that todays investment will have greater impact on the future life

It is interesting that , the father way of thought for his son is impressive. The way of agreement changed the son ‘s mind to think long-term success and more achievement than the current peer infulence interest on driving luxurious car. The son understood that todays investment will have greater impact on the future life

Very insightful💭

An asset is anything that puts money in our pockets, but a liability is something that takes money out of our pockets. Many people incorrectly classify some items as assets when they are actually liabilities. For example, a car and a house. Unless the car and house are used as rentals, they cost us money. The main moral lesson of the father-son conversation is that we should not buy luxury items before investing our money and making a profit. Lexus should only be purchased from the profit of our investment, and we should be patient until the investment yields a significant profit.

I really learn lots of things. Thanks for sharing such valuable things among us.

The son was more focused on short-term pleasures and what people thought about him. The fear of what others will say or think is a common obstacle to starting a business or pursuing a new opportunity. This reminds me of Chapter 5 of the Business School Book which talks about Value #5, “friends who will pull you up, not push you down.

Overally, differentiating between an asset and a liability is emphasized.

Very impressive in deed.

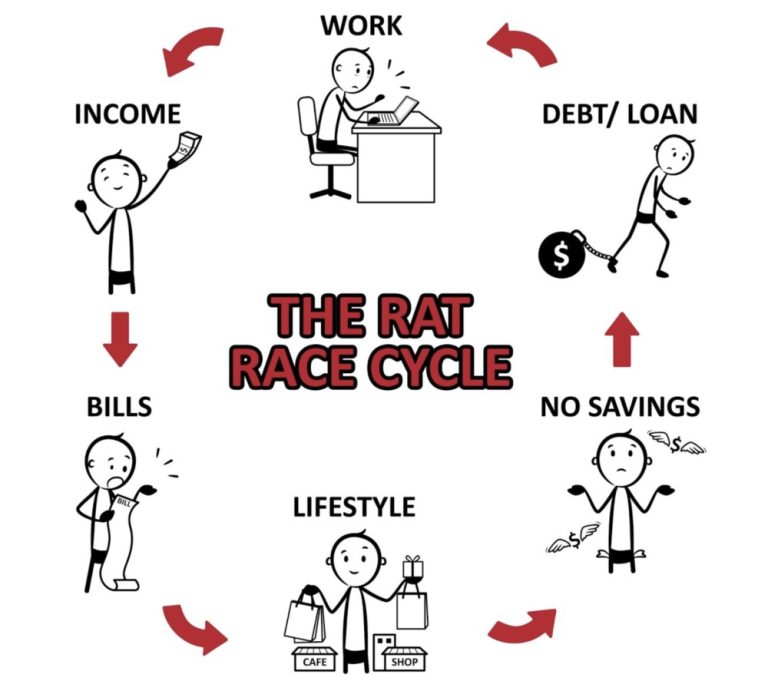

For the sole fact that over 90% of people do not know what is an asset and a liability nor their differences, poverty is inevitable. People will forever be stuck in the loop of acquiring liabilities and often swapping one liability to cover for the other liability. This forces them into a unhappy life because they have to work twice as hard or multiple jobs to made due and feed those finance-hungry liabilities.

Apt.

This is a valuable lesson that we need to teach our kids in order for them to survive in these competitive environments.

Very interesting story and one that teaches a lot. The majority of the things we think are assets are liabilities but due to a lack of financial literacy, we have not been able to distinguish between the two.

Financial literacy is key for us and our children if we want a better future and society.

It is so touching and real-life story people use.

Highly educating

Difference between liabilities and assets.

On Day, I was challenged by the word liability for not contributing to the family house hold;

At that moment, that word became an educational inspiration that I define it’s meaning.

That is to develope an entrepreneurial and innovative strategies for business competition to maximize profitability for sustainability.

I now define myself as an asset to the family for financial contribution as the result of wise business planning.

true facts

Very insightful, thanks for sharing this is an eye opener.

glad it was helpful.

In a nutshell; assets put money in your pocket, and liabilities take money out!

true

Wow… Very educative, what a piece of advice to learn from!!!

glad it was helpful.

Very correct, thank you for sharing.

glad it was helpful.

I’d love to be a member of the 1%club.

As children, we learn to walk, marking the beginning of our independence. Similarly, when the son asked his father for money to buy a car, the father agreed on the condition that he invest it, thereby encouraging the son to become financially responsible and self-sufficient. This act helped the son stand on his own feet.

glad it was helpful.

Another valuable lesson by 1% club. It is clear with each bills and expense made, that I am trapped in this cycle and have no financial freedom and a future role that’s already in the process of being fully automated.

glad it was helpful.

I have learned a lot, many people thought when you buy a car before investing you are good to go but you are rather buying a liability before asset.

Keep reading.

What you see as a need now might become a want ! Very insightful!

Thank God I come across this today. It’s an eye opener

This is a valuable lesson. The crave of wanting to fit in social class often make us settle on liabilities to the neglect of assets unconsciously.

This is the real lifestyles which we require on this earth, investment is key for enjoying financial freedom and avoid stressful slavery state.

This 1% Club did great visionary (mindset) tranforming us to direct easy life of multiplying money × money (Passive Income).

It’s really a powerful principle the father taught the son. The son was so disciplined and consistent in his business.

Very true. Thank you for sharing 🙏

Financial education is vital because it helps:

1. Make better financial decisions

2. Plan and save for the future

3. Manage and avoid debt

4. Invest wisely

5. Ensure financial stability

6. Promote responsible spending

In short, it’s key to long-term financial health.

Great insights around making the right investment decisions…where you ficus olon creating wealth rather than spending

Great investment insights around the story shared …

looking at the future optimistically rather than just spending today and not minding of tomorrow

Good father

What so ever just invest

Awosome! It is the greatest way teaching purified example tnx for sharing

I have learned a lot this will give you passive income for life time,Thank you very much .

Great value!

Very powerful lesson.

Very nice and true, I love to read it and I will implement in my life

got me laughing…

Very insightful and interesting, thanks for sharing.

It is an excellent advice from an experienced father. Making good use of opportunities appropriately will give one excellent results. And knowing our assets and liabilities will enhance our journey to financial freedom.

Very insightful indeed and a great lesson to all of us reading this. It has really given me great insight on the importance of investment in the future and the need to grow your investment for future generations to come. Happy to have taken time to read this article.

This is really insightful and informative

Profound piece of advice. Indeed there’s a lot to learn

Life lessons that we ought to teach our children at an early age…

Hiya, I am really glad I’ve found this information. Nowadays bloggers publish just about gossips and web and this is really irritating. A good site with interesting content, that’s what I need. Thanks for keeping this website, I’ll be visiting it. Do you do newsletters? Cant find it.

Extremely insightful, loved it afar. ✍️

Really great info can be found on site.

Inspiring. Great lessons learnt.

Thanks for sharing 🙏

It’s very important to know your need and your want so that it can help you when making financial planning

Marvelous Lesson! Had I get access to this kind of learning before, my life wouldn’t look like the way it is today !!!!

I really thank you for preparing such an interesting platform!

I learned that the more one invest on an asset, the lesson he/she will be interested in investing on liability!

A good lesson ever!

As a mom,i’m impressed. I will teach my family this technique

this will enable them to see the future with the energy to invest more

Thank you for sharing… What a dialogue 🥂

Learnt and drew inspiration from the Marathon v Relay, the history of employment , the parable of the pipeline, right, Dr Robert Kiyosaki cash flow quadrant and the Rich Dad Poor Dad. I felt that instead of building a business, buying a business rather partner a business to realiḥse your dream of becoming a big business. Let money work for not work for money and Be an entrepreneur and own boss

Good moral lesson